Digital Banking and Fintech

Be where your customers are.

Exist offers a solid digital banking solution that will enable banks to deliver next-generation services across digital channels.

Exist Digital Banking and Fintech (BFS) have already streamlined the solutions-building process by creating a foundational banking app that can easily integrate with core banking systems using a standard set of integration connectors to equip banks with capabilities to rapidly shift and compete in the digital economy.

For those in need of a modern and agile digital banking solution, Exist offers a faster and flexible way for banks to create and implement a solution that can be tailored to their own unique needs which can deliver a seamless customer experience across any device.

Our Digital Banking Engine

Innovation that transcends the future.

Secure

Compliant with OWASP

Acknowledging the sensitive nature of financial transactions and web application vulnerabilities like phishing and security breaches, our solution is compliant with the Open Web Application Security Project (OWASP).

SSL Certificate

Ensuring that your customers’ data are encrypted and can securely performs bank transactions, Exist implements Secure Sockets Layer (SSL) certificate and guarantees the passing of highest possible rating.

Multi-Factor Authentication

Access to the system will require multi-factor authentication (MFA) and all sensitive information will be encrypted on the database. This includes a customizable security phrase setup.

Biometrics

Requires the customers to register and utilize personal biometrics to open and manage their bank accounts.

Connected

API-Based Integration

Our digital banking solutions are integrated with Application Programming Interfaces (APIs) that keeps the database interconnected for an ideal financial ecosystem and helps your customers bank with ease.

Core Banking Integration

Integrating with Core Banking systems such as but not limited to Finnacle and Temenos T24, daily banking transactions with interfaces to general ledger systems and reporting tools can be seamlessly processed.

Payment Gateway Integration

With different payment gateways integrated into the solution such as Instapay, PesoNet, BancNet, and DragonPay, our solution ensures the security of fund transfers from banks to merchants.

Cloud-Ready

Experience Cloud Deployment

Our digital banking solution is deployable both on cloud, on premise, and hybrid. This allows your business to effectively scale up or down depending on your requirements and only pay for the resources that you consume.

Scalable

Enterprise-Grade System

Built for a high scale of service, our digital banking solution allows your customers to access their accounts via the website and mobile application both for iOS and Android.

Microservices Architecture

Developing single software systems each running independently enables your banking business to evolve as you scale without difficulty.

Flexible

Customization

The solution is modular, extensible, and allows for a wide-range of customization tailor-fit to your business needs. We collaborated with several banks in deploying mobile internet banking, online customer onboarding, loans management system and other digital banking solutions.

Specific Requirements

The system can be developed based on your business’ specific requirements. Our expertise in software development brings modern solutions to your problems.

Local Support

Home-Grown System

For more than 20 years, we have gained a foothold as the premier enterprise software provider in the Philippines. We help businesses achieve a competitive advantage with our innovative solutions.

Developers are in the Philippines

With software experts residing in the country, we can ensure your business with high-end technical support that will keep your banks up and running online.

Our Solutions

Go where digital banking possibilities are boundless.

Mobile Internet Banking

Digital banking is now the way to more conveniently, and securely, fulfill your banking needs. Exist Mobile Internet Banking MIB is a secure, cloud-ready, scalable, and flexible mobile-first application ready to meet your need for banking agility and the market’s ever-changing demands.

Loans Management System

LMS is an application that automates the process of applying and approving loans. With this new kind of technology, Exist can help banks connect with their customer and make availing of loans seamlessly. No more long queues, short application process, & paperless!

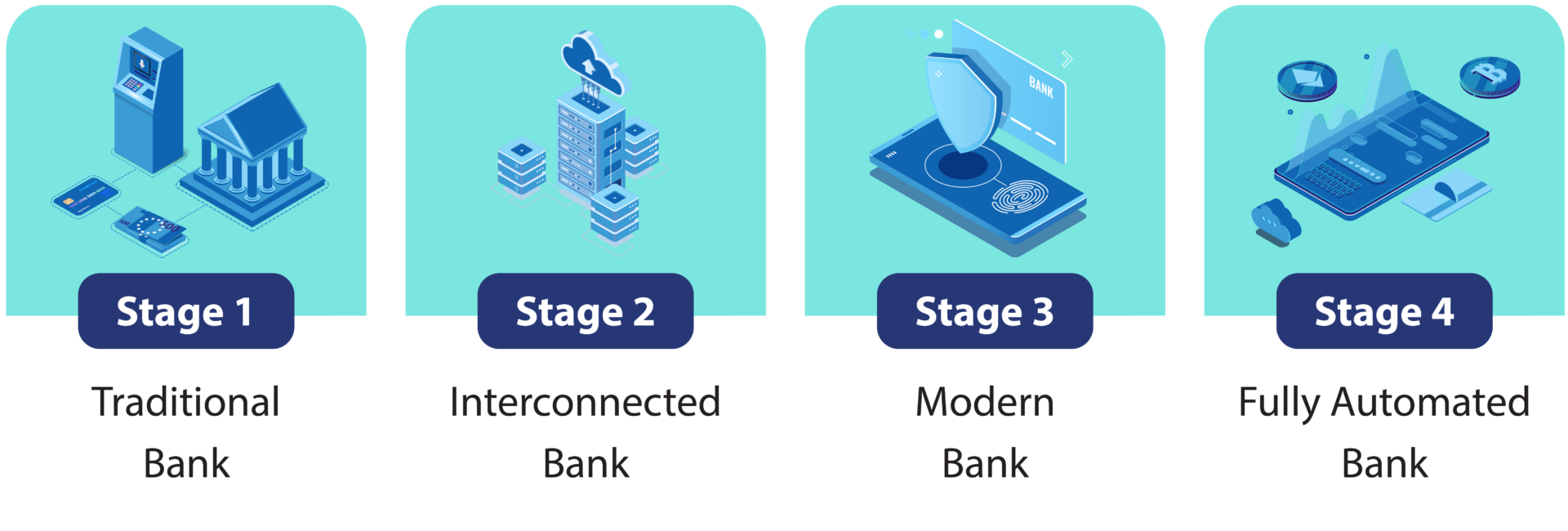

Free Banking Maturity Stage Assessment!

Be a premier provider of a banking innovation that the future needs.

“Exist is very easy to talk to and very efficient and effective in terms of Troo’s needs.”

Ms. Angela Marie Gilleran, Information Technology Controller – Troo

“We’ve been partners with Exist for over 2 years, and they’ve developed a number of Digital Solutions for the bank.”

Mr. Ramon Abasolo, SVP & Digital Retail Banking Group Head – Robinsons Bank

“The team at EXIST has brought us several technology innovations over the last few years and we look forward to continuing to push the digital envelope with them.”

John Howard Medina, Chief Operating Officer – PBCOM

Our Work