Renewable energy is the future of our planet, but the transition to a fully sustainable energy system is not without its challenges. From technological limitations to policy barriers, there are numerous hurdles that must be overcome.

Yes, renewable energy sources have been around for centuries, and for the past few decades, they have been gaining increased attention and promotion due to the need for more sustainable, environment-friendly, and cost-effective energy sources. However, with the increasing interest, there are a few challenges that have been identified with the use of renewable energy sources.

Challenges for Renewable Energy Sources

- Availability of reliable sources – Depending on the type of renewable energy, such as solar, wind, or hydro, these sources are dependent on certain weather or geographical conditions. Solar energy, for instance, can only be tapped during the day, and only if the skies are clear. Similarly, wind energy is highly dependent on wind speed, and hydro energy requires a large reservoir. Having such limited availability of renewable energy sources can be a challenge to its utilization and also leads to power outages due to the lack of a reliable source.

- The cost associated with the use of renewable energy sources – Compared to traditional energy sources like coal and gas, setting up renewable energy sources requires higher capital investments. For example, the cost of setting up a solar panel is significantly higher than the cost of purchasing coal or gas. This higher price tag is a challenge for countries and organizations that are looking to adopt renewable energy sources.

- Storage of renewable energy – Since renewable energy sources are available intermittently, storing this energy for future use can be a challenge. While newer technologies are being developed to address this problem, the existing technology does not suffice to store this energy in bulk for future use.

- lack of infrastructure – The infrastructure needed to support renewable energy sources is often much more expensive than traditional sources of energy. This means that countries and communities that want to switch to renewable energy sources must invest in new infrastructure or upgrade existing infrastructure. This can be a difficult and costly challenge to face.

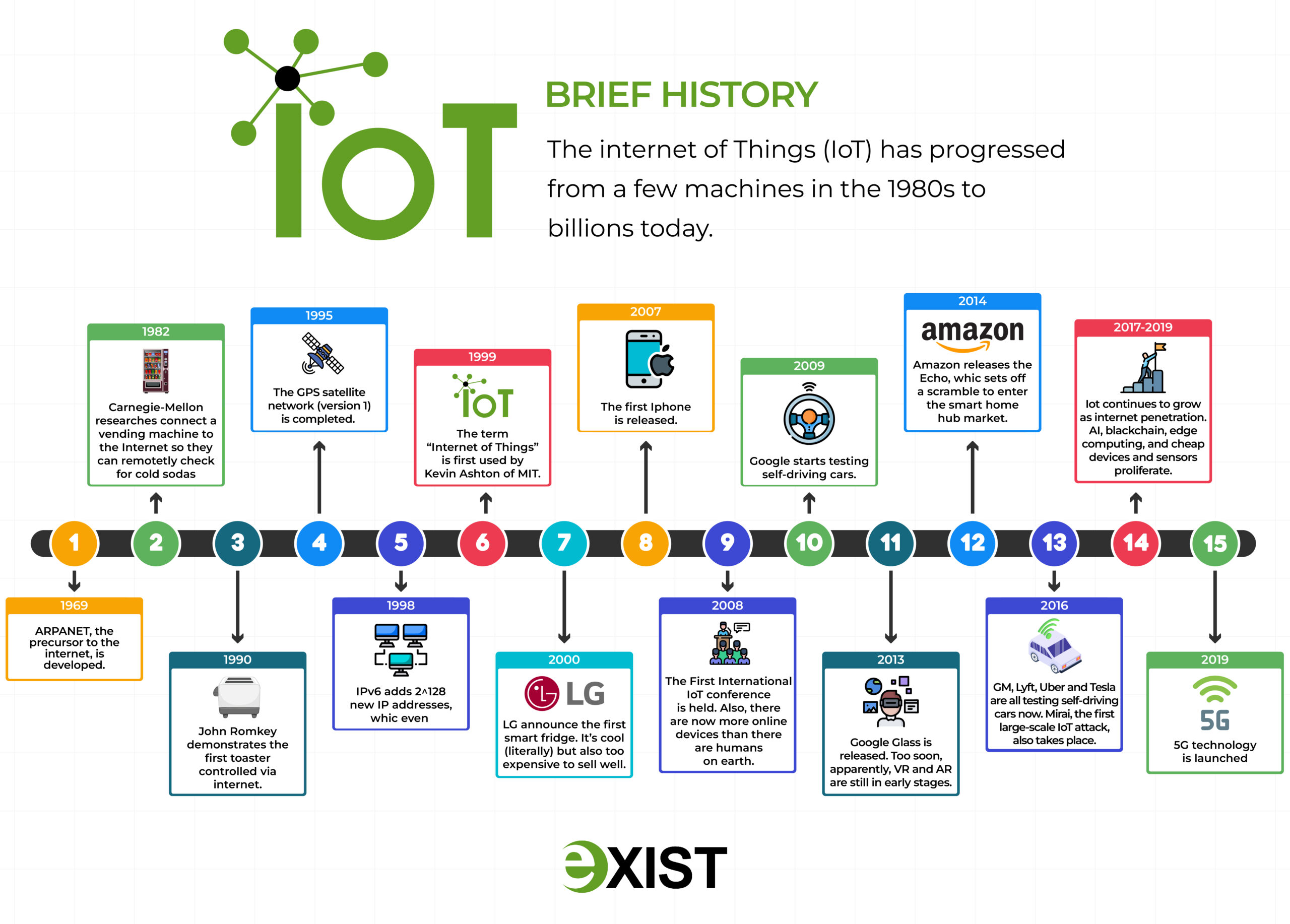

- Information technology – can also present a challenge for renewable energy sources. While information technology has provided a wealth of opportunities for renewable energy sources, it can also present a challenge in the form of cyber-security. For example, if a renewable energy source has been hacked, it could lead to catastrophic consequences. This is why it is essential that information technology is used responsibly and in accordance with strict security protocols.

Looking for solutions to these challenges? Schedule a free consultation today!

Despite the challenges, renewable energy sources are gaining traction due to the numerous advantages it offers. To address the availability challenge, many countries and organizations are investing in building smart grids. This allows the energy from renewable sources to be integrated with that from traditional sources, thus reducing the risk of power outages. To address the cost challenge, organizations are also offering subsidies and incentives to encourage the adoption of renewable energy sources. To tackle the storage challenge, advanced technologies like energy storage systems, such as batteries and flywheels, are being developed to ensure that the energy can be stored for future use.

Ultimately, renewable energy sources are a key component of our future energy needs. However, if we are to ensure that these sources are viable and reliable options for the future, it is important that we understand and address the challenges that they face. By investing in renewable energy sources, upgrading infrastructure, and utilizing information technology in a responsible manner, we can ensure that renewable energy sources are here to stay. With the right solutions and investments, these challenges can be addressed, paving the way for a greener future.

We understand that renewable energy poses unique challenges that require innovative solutions.

At Exist Software Labs, Inc., our team of experts is dedicated to developing cutting-edge software and hardware solutions that help energy businesses and communities make the most of clean energy.

Optimize your renewable energy production and storage, minimize downtime, and reduce energy waste with our advanced analytics and monitoring tools. Our smart energy management systems enable you to manage and control your energy usage in real-time, ensuring that you are always in control of your energy costs and carbon footprint.

By leveraging the latest technologies and working closely with our clients, we help you overcome the obstacles that stand in the way of a more sustainable future. We are committed to providing reliable and effective energy solutions that make renewable energy accessible and affordable for businesses of all sizes.

Are you ready to dive into the exciting world of renewable energy? As we look to transition to a greener future, there are certainly challenges to overcome. But fear not! With innovation and determination, we can find solutions to even the toughest obstacles.

1. Intelligent Grid

1. Intelligent Grid